At the beginning of last year, I shared that we paid off $36,000 of debt in 2013. At first glance that seems impossible considering our income was less than $40K, but since it was our first year getting serious about our debt payment we had some savings that we could apply toward our student loans.

Our debt payoff in 2014 wasn’t nearly as much as the previous year, which was expected. Still we worked hard and are happy with our progress.

At the request of readers, I’m finally putting our 2014 annual spending totals out there for all to see! You’d probably expect a post like this right at the beginning of the new year, but I’m a little slow. Thankfully I have readers who remind me!

Disclaimer

Before I share the numbers, I want to add a bit of a disclaimer. I share these details for information and curiosity’s sake. I don’t share them to boast or, on the other hand, to have people feel sorry for us. In no way am I suggesting that these numbers are the right target numbers for anyone else. It’s not a competition to spend the most or the least in a certain category. Since we all have different priorities, goals, and resources, our budgets and our spending will look completely different. And that’s just fine!

Totals for 2014

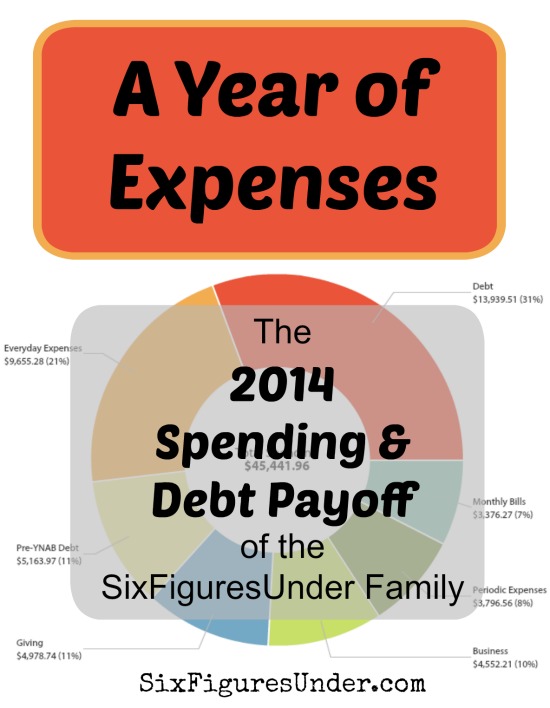

I’ll start with a pretty little graph from YNAB showing what we spent, then I’ll break each of those master categories down into what they cover and how much we spent in each sub-category.

Debt Payoff- $19,073

During 2014, we put just over $19K toward our student loans! Averaged over 12 months, that is $1,589 per month, but it was usually more. In January and February, we put next to nothing toward the loans, which pulled the average down. We were working to get living on last month’s income, which was well worth the effort since we can now maximize the amount we pay toward debt each month instead of just guessing.

In the lovely graph, our debt payoff is divided between the “debt” category (red) which is our student loans and the “pre-YNAB debt” category (yellow) which is the last of a balance transfer we used to save money on student loan interest (essentially student loan debt as well). Not included in YNAB are the payments the SmarterBucks made directly to our student loans, so the total would be slightly higher.

Everyday Expenses- $9,655

Gas– $5,429

Yep, that’s a hefty sum of money for fuel. It’s an average of $452 a month. My husband is on the road at least two hours a day commuting and driving for work. It’s definitely not ideal, but the trade-off is that we have free housing living in my in-laws’ basement out in the boonies.

Groceries– $3,187

Our goal is $300 per month, but with a no-spend month in there, it brings the average down a bit. Our average was $266 per month. There are lots of ways we save on groceries, including cooking from scratch, eating at home, stocking up, and growing a garden.

Household Goods– $477

This is our home catch-all category that includes toiletries (tp, shampoo, etc), non-food kitchen items (foil, trash bags, etc), office supplies (printer toner, staples, etc), and random things like furniture from yard sales and new camera batteries.

Clothing– $395

A portion of our clothing budget goes to dry cleaning. We also bought a new suit and dress shirts for my husband. I am really good at getting great deals on clothes for me and the kids (well, I got fabulous deals on the clothes for my husband, too).

Fun– $167

The amount of money spent here does not reflect the amount of fun we have! I know some people can spend that much in one night of fun. We just do a lot of fun things that don’t cost money. It helps that we don’t drink and neither of us is into movies or concerts. Lots of our fun activities are family-oriented and involve getting together outdoors, at friends’ homes, or at church-sponsored activities.

Giving– $4,979

Tithing– $4,809

We pay a 10% tithe on our income each month. I wrote a post about why we continue to pay tithing even though we are deeply in debt if you’re wondering why in the world we would give up so much money.

Other Giving– $170

Periodic Expenses– $3,797

Car Repairs– $932

The price of driving older cars includes the cost of repairs!

Dental– $927

In addition to our monthly dental discount plan, we paid for a couple of root canals and crowns.

Gifts– $816

This category is a little skewed because it includes money that was given to us as a gift to purchase actual tangible gifts. When we received the gift money we counted it as income, so when we spent the gift money (remember the triple bunk bed that my husband built?) we counted it as expense. You can get the rundown in December’s budget report if you are interested.

Life Insurance– $667

Mr. SixFiguresUnder just wrote all about what we pay in insurance.

Car Registration– $243

Includes registration for two vehicles and smog (emissions test) for one vehicle.

Medical– $212

Outside of the monthly premiums, this is what we paid in co-pays, most of which were for pregnancy.

Monthly Bills– $3,376

Health Insurance– $1,366

This includes our monthly health insurance premiums under the ACA.

Car Insurance– $1,075

We have two 1997 vehicles insured through USAA.

Cell Phones– $588

We switched to Republic Wireless in the middle of the year with their $10/month smartphone plan (and we’re loving it, by the way). This includes our purchase of two smartphones.

Internet– $140

Partway through the year, we started paying to increase the bandwidth on our home internet service (my inlaws pay for the $60 base rate for 10 GB). Having only 10 gigabytes of data per month made blogging really hard, so we paid an additional $30/month to increase the bandwidth to 20 gigabytes per month. We still have to budget internet use very carefully (absolutely no videos), but thankfully we should be getting a new provider at the end of the month.

Dental– $138

We paid for a dental discount plan for a while since we knew my husband would need some work done.

Renter’s Insurance $69

We had prepaid the first part of the year the previous year, but started paying it monthly in August.

Business– $4,552

Lawyer Marketing– $2,364

We had a 12-month contract for a print ad in a local publication. This also includes expenses for hosting a seminar, as well as dues for organizations that he is a member of for networking purposes.

Etsy Expenses– $922

I don’t report my Etsy expenses (fees, shipping, supplies) on our monthly report because I take them out when calculating my profit (which I do share). It looks outrageous, because it includes all the shipping costs, even though the customer pays for shipping. I just left the number here since it is included in the YNAB graph.

Law Practice– $705

This includes my husband’s law practice management software subscription, as well as his continuing legal education credits.

Blog Expenses– $545

If you have read my post about how to start a blog on a budget, you’ll be surprised that this number is so high. In the fall, after a year of spending next to nothing on my blog, I paid for a Restored 360 Designs theme built on the Genesis framework. I also paid for the Elite Blog Academy course (new “semester” launching soon), which is totally worth it if you are ready to take your blog “to the next level.”

eBay Selling Expenses– $16

I didn’t do very much eBay selling in 2014, just enough to owe a little bit in eBay commissions.

Whew! Well that pretty much covers everywhere our money went in 2014. That’s a lot of numbers. If it weren’t for YNAB, those numbers would have been a lot harder to put together. Thankfully we had the entire year’s-worth of data recorded there, otherwise a post like this would have been overwhelming to write.

How about you?

- Does anyone else out there keep annual totals like this?

- How did 2014 turn out for you?

Note: This post contains a few affiliate links. For more info, see my disclosure policy.

I’m not a regular reader, just kind of found this by accident, so forgive me if I’m asking something you’ve discussed elsewhere, but I can’t help wondering where your housing expenses are.

Hi Elisabeth! I’m glad you found me. 🙂 That’s a very good question (I’m surprised I didn’t put that detail in!). I post a budget report each month sharing exactly what we earned, spent, and paid off in debt, so my regular readers are know that we are currently living in my in-laws’ unfinished basement. We don’t pay rent or utilities (besides internet). I wrote more about it here and here.

This is impressive! It’s really great to be able to see exactly where you’ve been spending your money like this. I just started YNAB (thanks to you!) in January and it’s amazing how much it’s helped out. I was living on the credit card float and didn’t even realize that meant I was living on NEXT month’s income. I’m happy to announce that the float is gone and I’m now living on THIS month’s income. Next stop is to start living on LAST month’s income. I may not get there till the fall, but that’s okay. In the time being, I’m paying off tons of money on my debt and should be debt free by next summer! Thank you for your help and inspiration!

Great job. I use Quicken, and track what I spend. It helps to understand just how much goes to be ‘wasted’. Far too many meals eaten out.

I’m blown away, Stephanie. Just when I think I can’t shave any more off our monthly budget, I read your blog and come up with new ideas. I’m setting up my Etsy shop this week (don’t worry, no direct competition), and am brainstorming for side hustle ideas. We paid off $4,132 in debt last month, and are on track to pay off $3,583 this month. We’re chasing our dreams, partly thanks to you! I’ve got better things to do in life than run the debt hamster wheel. Keep up the good work, for all of us!

Thanks for sharing this! You have done an awesome job!

I have a question about your student loan payments. I have been wondering this for a while, and figured this is a good opportunity. Since you don’t have a regular required student loan payment—how does your loan interest get paid? Is the 19K all towards loan principal, or is some of that towards interest?

In my YNAB set up, I have a major category for “Debt” including sub categories “regular student loan monthly payment” (obviously some of that goes to interest and some to principal) and “extra principal payment”. How does your budget work since you don’t have a regular required payment?

Go you! That’s pretty great considering all the kids. I haven’t done annual totals yet, because I’ve only been keeping really good track starting in late summer 2014, but I am really interested to see how my total numbers for 2015 come out. (Of course they might be affected by a potential job-related move in the summer.)