I am back on track with budget updates! If you missed our May 2023 budget update, that will get you up to speed on what we have going on.

For those who have been waiting for the post explaining the details of how we are working the finances for the Ukrainian family that we’re sponsoring, that is still coming. (It’s waiting on Mike’s edits and he’s as busy as I am!) Of course, you can get a general idea just by looking at our budget here. June was our second month of having our guests here.

We had lots of extra income in June (which will be nice for July’s budget), but June’s budget was on the tight side with the increased expenses and cutback on income. We didn’t fund most of our sinking fund categories in June, as you’ll see outlined in this post.

Okay let’s take a look at our numbers for June 2023. As always, feel free to ask if there’s anything that doesn’t make sense or you would like me to clarify.

Income Earned in JUNE – $16,721

We live on last month’s income. If that doesn’t mean anything to you, check out the video explaining how living on last month’s income changed our lives or the post explaining how we got to that point.

This income section shows the money we earned in June, which has all been set aside to use in our July budget. The spending section below shows the money we earned in May and spent in June.

Attorney Income – $9,016 Mike works as an attorney for the state of California. This is his take-home pay after taxes, social security, his pension contribution, and health insurance premiums.

PTO Buyback- $5,144 Once a year, Mike’s employer allows him to cash in some of his paid time off. Since he accrues PTO faster than he uses it, he usually cashes some of it out each year.

Rental Income – $0 For years we rented out a one-bedroom apartment on our property through Airbnb. We gave that up to take in a Ukrainian refugee family for a couple of years. We loved Airbnb and will likely go back to that in the future. If you’re thinking about renting out your space on Airbnb, check out Mike’s post about dealing with insurance for your Airbnb rental or our explanation of how we handle our Airbnb finances.

Law Firm- $0 Before working for the state, Mike did estate planning and business transactions. Over the last few years he has had a steady stream of potential clients, most of whom he refers to other attorneys, but he still occasionally helps former clients. He doesn’t cut himself a paycheck each month, just a couple of times a year.

Blog – $2,561 My blogging income took a major hit when I put the blog on the back burner during Covid to start homeschooling my kids. Since then it really hasn’t recovered. The income still covers my blogging expenses (which are a lot more than most people would guess). I only pay myself a couple times a year now.

Spending in June

Each month we allocate every dollar earned in the PREVIOUS month into our budget categories for the current Month. For June, we budget and spend the money we received in May.

Giving

Tithing – $1,032 We always pay a 10% tithe on our income. Like all of our June spending, this comes from the money we earned in May. You can read our thoughts on paying a 10% tithe here.

Fast Offering – $40 Each month we take one day to fast (go without food and drink) for two meals and contribute to a program that provides assistance for local folks who need it.

Monthly Bills

Mortgage – $2,380 We have a 15-year mortgage on our house. With mortgage interest higher now, and potentially still climbing, we’re so grateful we were able to lock ours in at 2.375%. If you’re interested in the details of our Dec 2020 refi, you can check out all of the numbers and details.

Electricity – $6 We are finally reaping the benefits of our huge investment into solar. We are producing enough solar energy to cover all of our current usage, plus some credit to go toward winter months. The small bill is just for random service fees that can’t be avoided. I should also note that we are still very conservative with our electric usage (we very rarely use our air conditioning) while we wait to see how the year’s solar true up goes.

Car Insurance – $189 Our car insurance went up now that we have a third vehicle (see this post if you don’t know what vehicle I’m talking about) and we drive much more. Our insurance is through USAA and we love them! If you, your parent, or your spouse were/are in the military, you’re probably eligible for USAA too!

Internet – $70 Having good internet access is super important with Mike working from home. We’re so glad we invested in bringing internet access to our property when we first bought our house. That $5,000 investment was worth every penny!

Water – $75 Our water bill comes every other month, so on months that we don’t have a bill due, we set aside half of what we expect the next bill to be.

Garbage- $88 We normally set aside half of our trash bill each month, but we didn’t do that in May, since things were extra tight, so we had to pay for nearly the whole bill in June (there was only $6 in the category from previous months).

Cell Phones – $184 We now pay for seven cell phones: for me, Mike, our oldest child, one used as a home phone, and three for our Ukrainian friends. They are all through Visible. Visible is a Verizon subsidiary that offers wifi calling and unlimited cell calls and data on the Verizon network. We’ve been using them for several years now and have no complaints at all. It is $25 per phone with unlimited data per month, but right now you can get the first month for just $5 through my link.

Music Lessons – $0 We have paused music lessons because our daughter is extremely busy right now. Our music teacher has generously offered his time and talent to teach our 11-year-old Ukrainian girl. What a blessing!

Everyday Expenses

Food – $757 Being so busy with transportation and logistics for the past two months, I have not been very intentional about planning meals or grocery shopping. I haven’t been doing a big monthly grocery haul like normal. July will probably be crazy too. In August I will get back to monthly grocery hauls.

Food prices are definitely higher than they were a few years ago, but I still believe almost everyone can spend significantly less than they currently do on groceries. You can learn all about my strategies and method in Grocery Budget Hero now. Get $20 off with the coupon code STARTNOW. That puts your total cost at $39, and I promise you’ll earn that back many times as you build your grocery budget hero skills.

Fuel – $1,006 Our gas cost was nearly the same as last month. With the kids out of school, we’re doing a lot more driving. Our two oldest (along with the 15-year-old Ukrainian boy) work 4-6 days a week. None of them drive yet, so I am their taxi. We also have almost everyone doing summer swim team, plus two in cross country and one in wrestling.

For a week and a half Mike drove our Ukrainian mom to her English school (45 minutes away). He would work in the car or at the library while she was at her class for 3 hours, then drive her home. She now rides the bus both ways which takes about two hours each way, but she loves the independence it gives her and now we only have to drive her 10 minutes to the bus stop. We also drive her to lots of appointments related to getting settled and receiving government benefits in the United States.

Household Misc – $1,024 Mike needed to upgrade some things on our home computer (which he also uses for work), so about half of this spending was computer related. We also renewed our Sam’s Club Plus membership. We bought a dresser at the thrift store and some kitchen things at a garage sale. Of course there were normal, small household things along with a couple of subscriptions.

Clothing – $238 – I ordered probably a dozen pairs of running shoes for my two oldest kids to try on and choose from (and then return the ones they didn’t like). Mike is a buy-in-person kind of person. I prefer to order lots of options online, try on at home, and make returns as needed.

Animals – $114 We bought dog food, cat food, and chicken feed. The price of chicken feed has nearly doubled from three years ago! Chickens are basically pets with benefits, not a money-saving strategy (and ours even free-range all day long)!

Allowances – $84 We give our kids “practice money” as a weekly allowance. You can read all about why we decided to pay our kids allowance that’s not directly tied to chores, as well as all the details of when and how much in this blog post.

Sports – $150 We paid for basketball and wrestling in June.

Sinking Funds

For most of our budget categories, we zero out what is left at the end of the month and send it to whatever our big financial goal is at the time, but in our sinking funds we set aside money each month for periodic expenses and let it build up until we need it.

The amount in bold is the amount we added to the fund this month. Any spending is noted in the comments along with the current balance of each fund.

We do not have separate bank accounts for these funds. All of the money sits in our checking account. We’re not worried about getting the money mixed up because we spend according to our budget category balances, not our checking account balance. We seriously never even look at our checking account balance unless we’re reconciling the account. We track our budget categories and spending in YNAB.

Both May and June saw higher spending in part due to the arrival of our newcomers. Since the budget was tighter than normal, we didn’t add to most of our sinking funds in June. We will make up for some of this in July since June’s income was higher.

Medical/Dental – $0 added. We spent $57 in June on a doctor visit for a wrist injury as well as a wrist brace. Current category balance is $2,390.

Car Maintenance – $0 added. We spent $0 in June. Current category balance is $984.

Christmas – $0 added. We didn’t spend anything for Christmas 2023. Current category balance is $935.

Disability Insurance- $190 This will replace about 2/3 of Mike’s current income if injury or illness leaves him unable to work as an attorney. Our income potential is our greatest financial asset right now and disability insurance helps us protect it. We put money aside each month to pay the premium when it’s due each year. Current category balance is $597.

Life Insurance – $100 added. Next year’s life insurance premiums will be due in November. Current category balance is $700.

Birthdays & Gifts – $0 added. We spent $0 in June. Current category balance is $122.

Car Registration & Smog – $43 added. We spent $231 in June for a car registration renewal. The sad part of that is that $75 of that was a late fee. We got the renewal notice months in advance and both thought that it was paid. We didn’t realize it wasn’t paid until we got the late bill. I hate making dumb mistakes like that. Current category balance is $0.

Family Fun Fund – $0 added. We spend $0 in June. Current category balance is $347.

Home Projects- $0 added. We didn’t spend any in this category in June. The category balance is currently $211.

Garden & Orchard- $0 added. We didn’t spend anything in June. The category balance is currently $0.

Investing

Kids’ 529s – $150 We know that $25 per kid per month invested for college isn’t much, but college costs are not our highest concern. Scholarships, grants, loans, and jobs during school worked for us. We may accelerate this savings later, but we’re ok with small, consistent payments right now. The kids like to see their balances growing, and it adds up and teaches them good savings principles, even if it won’t entirely pay for school. You can read about our decision to start saving a little for college in this post.

IRA (Steph) – $542 With $542 monthly, I’ll max out my $6,500 IRA contribution for the year. Mike has about $1,200 each month deducted directly from his paycheck for retirement.

Goal Progress

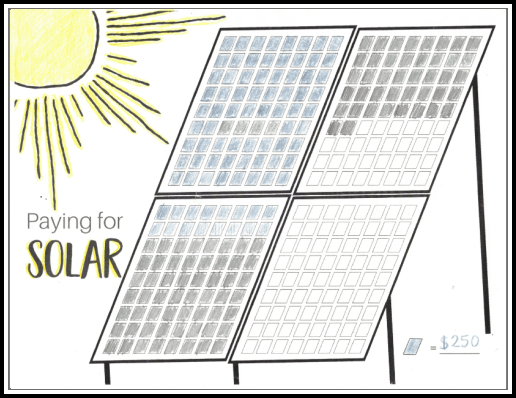

We are just paying normal mortgage payments for a few more months while we finish up an interim goal–paying off our solar installation. Mike and I shared all the details here about why we are getting solar, how much it costs, and how we’re planning to pay for it here in this post.

We are so excited to finally have solar all set up and running (it took over a year, which is ridiculous!!)! We are hooked up to the grid, so what we produce (over what we use) during sunny hours will be sent back to the grid and will help offset what we use during non-sunny hours. Our system doesn’t include any batteries.

The total cost of getting solar was $70,000 (plus about $3,000 of interest on the $50K loan if we pay it off in 2 years). We started making payments on the $50,000 loan in April 2022. Our payments are $1,502 per month.

Our contribution to our solar goal in June was $742 which is actually only half of what our normal monthly payment is. Don’t worry- we made the full payment, as we have funds built up in YNAB.

The way we have it set up in our budget is kind of like a sinking fund. We put money into our “solar” category each month. Some months it is a lot; some months it is a little. There is an automatic payment of $1,502 toward the solar loan each month that comes out of a separate budget category.

That brings the total we’ve paid towards solar so far to $46,533.

I made a chart to keep track of our progress. I color in a little square for each $250 we put toward our solar purchase.

How About You?

- How did your budget and/or debt repayment go in June?

This post contains affiliate links for products or services that we love and recommend.

Hi Stephanie, I followed your journey for several years quite a while back and wanted to let you know that some of your teachings stayed with me. My husband and I have just plodded along with our finances with no goals or intention in our spending…we’ve wasted so much money! At the end of last month we finally decided that we need to be more intentional if we want to experience more from life and straight away I downloaded the free trial of YNAB. We’re only 9 days into using it and I can’t believe the peace of mind it is giving me knowing that we have everything covered this month, it’s really transformative! I also realised that our pet insurance was due for renewal so I looked around for a cheaper deal and saved a whooping £800 per year in one day just by switching to a different company – same value of insurance just cheaper premiums!! Thank you so much for sharing your journey.

P.S Do you have any discount codes for YNAB annual subscriptions?

Congrats on getting on back on track Mandy! It’s amazing the peace that comes from just taking the first steps to get organized and to have a goal/plan. And that’s a huge savings on the pet insurance. It pays to shop around!

I wish I had a discount code to share. I used to back when it was a one-time purchase, but I don’t now that it’s a subscription. The annual subscription is a huge savings versus the monthly price, so I would definitely go with the annual. It will be the best $99 you spend all year. 🙂

I don’t have a monthly water bill because I am on a well. I do use electricity when my well pump is running.

Hooray for no water bill! That’s great Gen!

I can’t even fathom a $16k income per month. That’s about what I make in 6 months. 😳

Go read some of their very early budget posts when they were just getting started on paying off student loans. Don’t give up.

We definitely don’t earn $16K per month either. This month was an exception because my husband cashed in his PTO (more than half a month of PTO) and I paid myself for blogging (first time this year). Our income has steadily increased over the years. For example, look at what our regular income looked like 9 years ago: https://www.sixfiguresunder.com/june-2014-debt-repayment/

But the whole point of sharing budget updates isn’t so that readers can compare. Everyone’s income is different, but so are everyone else’s expenses. Family size, location, and needs differ. I hope that even though our numbers may be drastically different than yours, you can still learn from the budgeting principles.

Cool beans – the $6 electric bill!

Yes! That part is pretty exciting! It’ll be even more exciting when the solar is paid off!