It has been about eight months since I’ve shared a family budget update. That’s a long time, considering I published monthly budget updates for NINE years without missing a month.

As you probably know, there have been some major changes since our last budget update in September. The most notable is that we took in a Ukrainian refugee family of four.

I’ll be dedicating an entire post soon to explaining how we handle financial matters with them, but I wanted to get May’s budget update published before it’s July, so I’m going with the budget update first.

Let’s take a look at our numbers for May 2023. As always, feel free to ask if there’s anything that doesn’t make sense or you would like me to clarify.

Income Earned in MAY – $9,016

We live on last month’s income. If that doesn’t mean anything to you, check out the video explaining how living on last month’s income changed our lives or the post explaining how we got to that point.

This income section shows the money we earned in May, which has all been set aside to use in our June budget. The spending section below shows the money we earned in April and spent in May.

Attorney Income – $9,016 Mike works as an attorney for the state of California. This is his take-home pay after taxes, social security, his pension contribution, and health insurance premiums.

Rental Income – $0 For years we rented out a one-bedroom apartment on our property through Airbnb. We gave that up to take in a Ukrainian refugee family for a couple of years. We loved Airbnb and will likely go back to that in the future. If you’re thinking about renting out your space on Airbnb, check out Mike’s post about dealing with insurance for your Airbnb rental or our explanation of how we handle our Airbnb finances.

Law Firm- $0 Before working for the state, Mike did estate planning and business transactions. Over the last few years he has had a steady stream of potential clients, most of whom he refers to other attorneys, but he still occasionally helps former clients. Nothing this month, though.

Blog – $0 My blogging income took a major hit when I put the blog on the back burner during Covid to start homeschooling my kids. Since then it really hasn’t recovered. The income still covers my blogging expenses (which are a lot more than most people would guess). Since the earnings aren’t much I don’t pay myself every month.

Spending in May

Each month we allocate every dollar of the PREVIOUS month’s income into our budget categories for the current Month. For May, we budget and spend the money we received in April.

Giving

Tithing – $1,032 We always pay a 10% tithe on our income. Like all of our May spending, this comes from the money we earned in April. You can read our thoughts on paying a 10% tithe here.

Fast Offering – $40 Each month we take one day to fast (go without food and drink) for two meals and contribute to a program that provides assistance for local folks who need it.

Monthly Bills

Mortgage – $2,380 We have a 15-year mortgage on our house. With mortgage interest higher now, and potentially still climbing, we’re so grateful we were able to lock ours in at 2.375%. If you’re interested in the details of our Dec 2020 refi, you can check out all of the numbers and details.

Electricity – $6 We are finally reaping the benefits of our huge investment into solar. We are producing enough solar energy to cover all of our current usage, plus some credit to go toward winter months. The small bill is just for random service fees that can’t be avoided. I’m definitely not complaining!

Car Insurance – $102 Our car insurance will be going up shortly, now that we have a third vehicle (see this post if you don’t know what I’m talking about). Our insurance is through USAA and we love them! If you, your parent, or your spouse were/are in the military, you’re probably eligible for USAA too!

Internet – $70 Having good internet access is super important with everyone at home for work and school. We’re so glad we invested in bringing internet access to our property when we first bought our house. That $5,000 investment was worth every penny!

Water – $125 We are happy to have a normal water bill back after some unfortunate water use months.

Garbage- $0 We normally set aside half of our trash bill each month, but we didn’t do that in May, since things were extra tight.

Cell Phones – $221 We now pay for seven cell phones: for me, Mike, our oldest child, one used as a home phone, and three for our Ukrainian friends. They are all through Visible. Visible is a Verizon subsidiary that offers wifi calling and unlimited cell calls and data on the Verizon network. We’ve been using them for several years now and have no complaints at all. It is $25 per phone with unlimited data per month, but right now you can get the first month for just $5 through my link.

Music Lessons – $0 We have paused music lessons because our daughter is extremely busy right now. Our music teacher has generously offered his time and talent to teach our 10-year-old Ukrainian girl. What a blessing!

Newcomer Expenses – $1,678 Most of this was not actually from our April income. We had an outpouring of generosity from wonderful friends, neighbors, and people we’ve never met who donated cash, gift cards, and other donations (even a van) that covered most of these expenses! This category includes the cost of three cell phones, one Chromebook, two summer swim team registrations, and some home furnishings. Thanks to the wonderful response to our Target registry on their behalf, we didn’t need to purchase very many more things.

Everyday Expenses

Food – $902 No, we didn’t drastically increase our grocery budget. In fact, we actually ate through some food storage instead of keeping it restocked like I normally do. Instead, we stocked the pantry, fridge, and freezer for our Ukrainian friends. Since their arrival they have been insistent about paying for their own food when they go to the grocery store themselves, though I still pick up things for them. In the next month or so they will be approved for public benefits that will help with food expenses.

Fuel – $992 With the kids out of school, we’re doing a lot more driving. Our two oldest (along with the 15-year-old Ukrainian boy) work 4-6 days a week. None of them drive yet, so I am their taxi. We also have almost everyone doing summer swim team, plus two in cross country, one in wrestling, and one in basketball training. We also had a couple of longer trips in a big (low MPG van) – including 2.5 hours to San Francisco to pick our Ukrainians up at the airport and a visit to Lake Tahoe for Memorial Day. Gas prices here have been around $4.39.

Household Misc – $459 We spent $100 on annual Google storage and another $100 on a pop-up sunshade tent to bring to swim meets and other sports. Some of this also included costs related to our Ukrainians like airport parking and tolls.

Clothing – $84 – We got some summer clothes and swimsuits for some of the kids.

Animals – $0 We had stocked up on animal food in April, so we didn’t need any in May.

Allowances – $84 We give our kids “practice money” as a weekly allowance. You can read all about why we decided to pay our kids allowance that’s not directly tied to chores, as well as all the details of when and how much in this blog post.

Sports – $137 We paid for basketball and wrestling in May.

Sinking Funds

For most of our budget categories, we zero out what is left at the end of the month and send it to whatever our big financial goal is at the time, but in our sinking funds we set aside money each month for periodic expenses and let it build up until we need it.

The amount in bold is the amount we added to the fund this month. Any spending is noted in the comments along with the current balance of each fund.

We do not have separate bank accounts for these funds. All of the money sits in our checking account. We’re not worried about getting the money mixed up because we spend according to our budget category balances, not our checking account balance. We seriously never even look at our checking account balance unless we’re reconciling the account. We track our budget categories and spending in YNAB.

With our new friends coming from Ukraine in May, our spending in general was higher. With a tighter budget than normal, we didn’t add to most of our sinking funds.

Medical/Dental – $0 added. We spent $0 in May. Current category balance is $2,447.

Car Maintenance – $0 added. We spent $0 in May. Current category balance is $984.

Christmas – $0 added. We didn’t spend anything for Christmas 2023. Current category balance is $935.

Disability Insurance- $190 This will replace about 2/3 of Mike’s current income if injury or illness leaves him unable to work as an attorney. Our income potential is our greatest financial asset right now and disability insurance helps us protect it. We put money aside each month to pay the premium when it’s due each year. Current category balance is $407.

Life Insurance – $100 added. Next year’s life insurance premiums will be due in November. Current category balance is $600.

Birthdays & Gifts – $0 added. We spent $0 in May. Current category balance is $122.

Car Registration & Smog – $0 added. We spent $88 in May to smog the big van and transfer the title. Current category balance is $188.

Family Fun Fund – $0 added. We paid a $332 to stay two nights at a condo in Tahoe over Memorial Day weekend. Current category balance is $347.

Home Projects- $0 added. We didn’t spend any in this category in May. The category balance is currently $211.

Garden & Orchard- $163 added. We spent $330 on garden irrigation supplies for new garden beds that Mike built in April. The category balance is currently $0.

Investing

Kids’ 529s – $150 We know that $25 per kid per month invested for college isn’t much, but college costs are not our highest concern. Scholarships, grants, loans, and jobs during school worked for us. We may accelerate this savings later, but we’re ok with small, consistent payments right now. The kids like to see their balances growing, and it adds up and teaches them good savings principles, even if it won’t entirely pay for school. You can read about our decision to start saving a little for college in this post.

IRA (Steph) – $542 With $542 monthly, I’ll max out my $6,500 IRA contribution for the year. Mike has about $1,200 each month deducted directly from his paycheck for retirement.

Goal Progress

We are just paying normal mortgage payments for a few more months while we finish up an interim goal–paying off our solar installation. Mike and I shared all the details here about why we are getting solar, how much it costs, and how we’re planning to pay for it here in this post.

We are so excited to finally have solar all set up and running (it took over a year, which is ridiculous!!)! We are hooked up to the grid, so what we produce (over what we use) during sunny hours will be sent back to the grid and will help offset what we use during non-sunny hours. Our system doesn’t include any batteries.

The total cost of getting solar is $70,000 (plus about $3,000 of interest on the $50K loan if we pay it off in 2 years). We started making payments on the $50,000 loan in April 2022. Our payments are $1,502 per month.

Our contribution to our solar goal in May was $1,502 which is just our monthly payment on the loan.

That brings the total we’ve paid towards solar so far to $45,791.

The way we have it set up in our budget is kind of like a sinking fund. We put money into our “solar” category each month. Some months it is a lot; some months it is a little. There is an automatic payment of $1,502 toward the solar loan each month that comes out of a separate budget category.

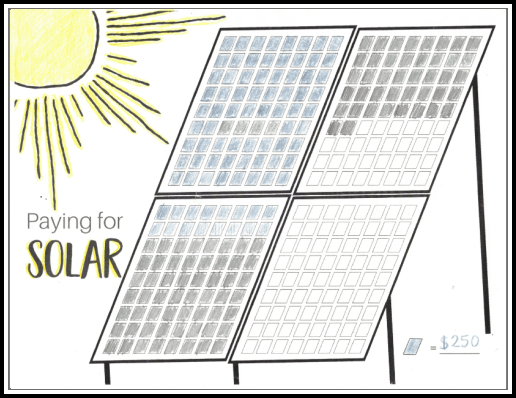

I made a chart to keep track of our progress. I color in a little square for each $250 we put toward our solar purchase.

How About You?

- How did your budget and/or debt repayment go in May?

This post contains affiliate links for products or services that we love and recommend.

So glad to see you posting again – I appreciate the motivation I get from hearing about your challenges (and successes). What amazing service you (and sounds like with some kindness from others) are providing for this Ukranian family.

Happy so see you posting again!!! Love seeing these posts! Can I ask why your solar was so expensive? I also live in CA and just installed solar on my home and it was $25,000 and I have a huge system. Did you do a solar roof or just panels?

Hi Catherine! Do you know the size of your system? I would be curious to know. Ours is a 15 kilowatt system that is ground mounted. We live in a canyon where some early and late sunlight is blocked by the hills on either side, so we needed more panels (versus someone who lives in a flat area with uninhibited and longer sun access) to generate the amount of electricity we use. We got solar quotes several years earlier (pre-covid) and if I remember right they were around $45,000, so the cost went up significantly.

Also, the $70K cost does not include tax credits that will reduce the total out of pocket cost. We took advantage of the Residential Energy Efficient Property Credit which counts 26% ($18,200) of the total cost of solar against our federal income tax liability. The result is that for 2022, and into future years until we use up the $18,200 tax credit, we won’t owe any federal income taxes.

When the sales people talk to you about the cost of solar, they figure in this 26% “discount” even though you need to total cost up front because the credit comes over time. When we recoup those tax credits our solar will have cost $51,800.

Do you know if your $25K cost is before or after the tax credit?

Wow, solar is expensive to install! That’s so neat to have though.

Yes! It is definitely expensive, that’s why we passed on it several years ago (back when the quotes were $45K instead of $70K). The cost of electricity is increasing rapidly, so by the numbers it makes sense and will pay off, but it is a big expense up front. I will be excited to have it paid off!

I’m so glad you are back, Stephanie! It’s great to get an update on the Ukrainian family and I’m so glad things are going well. In January 2020 I moved from an online monthly budget app to spreadsheet, using your budget spreadsheet form as a starting point. It’s been life changing – thanks! Your clear explanations of sinking funds and living off last month’s money have also been so helpful.

Thanks for the kind words Elaine! I’m glad that your budget is working out well for you!

I am so happy to see this is back! You are a source of inspiration! I signed up for your grocery hero course a while ago but have been in school and haven’t had time to do it yet. My classes end next week so I am going to take it on then.

Thank you Nicole! Hooray for getting a break from your classes! Time to tackle the grocery budget!

Thanks so much for your update! Changing to your manner of budgeting really helped us and is much easier to breathe easy and not get stressed about our budget.

That’s always so good to hear Sherrie! 🙂

So glad to see a post from you!!! Awesome that you are helping refugees and staying on track! You guys are wonderful!

Aww thanks for the kind words Annie! 🙂

Yay! So glad you’re back!!! God bless you for taking in this Ukrainian family!!!

It’s good to be back! Thanks Holley! 🙂

I was just thinking of you today because I’m beginning to plan a family trip to DC. I see you had 10 days. Would you go a longer or shorter time if you could do it over again?

Oh fun!! We LOVED our trip to DC. We thought 10 days was actually the perfect amount of time for our family. Of course there were still many more things that we could have seen with more time, and we kept a pretty full schedule, but much more probably would have been overkill for the little ones. I’m sure we will go back again sometime when our youngers are older. Have a wonderful trip!

Thank you! We are in the early early planning stages but I have referenced you blog post a few times already. We do typically use Airbnb and we don’t eat out. Packing for a flight would be a big change from filling up our van but the idea of flights vs a very long drive is very appealing.

Thanks for sharing your monthly budget! I had a couple of questions – what are you basing your 10% tithe on (since tithing was not 10% of your take-home income)? I don’t imagine there’s a hard-and-fast rule about it, but I’d be interested to hear your thought process. Second, were your Ukrainian friends able to accompany you to Tahoe? I’m hopeful that they are able to see some of the beautiful parts of this country, although I’m sure they must be missing their home country very much.

Most people I know, and the biblical financial training I received uses the gross income do you are giving before taxes.

Hi Ronni! Thanks for reading!

For tithing, we base it on the previous month’s income (so in this case it was April’s income) because of our living on last month’s income we don’t touch any of April’s income until May 1st. It’s a little more complex than just “net vs gross” though because some things (like the cost of health insurance) come out of the paychecks before we receive them. We add those costs back in before calculating tithing (so that’s why tithing is higher than 10% of our take-home pay). We don’t pay tithing on what goes to taxes, but we do pay tithing on our tax refund. Same with social security. We don’t pay taxes on that money, but when/if we receive money from social security we will pay tithing on that money. Hopefully that makes sense, if not feel free to ask a follow-up question.

YES! We brought our new friends to Tahoe too! Where they are from the elevation is 150′ above sea level. Where we stayed in Tahoe is 7,500′ above sea level, so it was a whole new world for them. They were taking lots of videos out the window of the van the whole way there!